Today is the first day of August, which is also the turning point of the airline market predicted by the industry, but the global shipping market is still depressed!

The Freightos Baltic Index (FBX), developed by Freightos and Baltic, a leading global digital logistics platform, recorded another 3% decline last week, to $6,120 per FEU

In the past few months, freight rates as a whole show a cliff down!

It is reported that in August, China's ports, including Hong Kong and Taiwan, showed a trend of increased suspension of navigation, among which Shanghai canceled 12 percent of available voyages in August, Ningbo, Xiamen and Shenzhen are all exceptions.

According to statistics from US freight forwarders, 95 trips to the US were cancelled in August at ports in Shanghai, Ningbo, Shenzhen, Nansha, Xiamen, Qingdao, Tianjin and Taiwan.

"An increasing number of carriers are facing delays at U.S. ports, leaving vessels returning to Asia unable to meet their next scheduled inbound voyage," said Alan Baer, CEO of OL USA. "As a result of the increase in empty navigation, available capacity is reduced and, ultimately, transport costs are increased. Reduced volumes may initially help ease upward pressure on prices, but, if volumes increase, available space will tighten quickly."

Cancellations and congestion will keep a floor under sea freight rates. Until all congestion is cleared, inflationary pressures will continue to be passed on to consumers; But unfortunately, the flow of trade has been blocked.

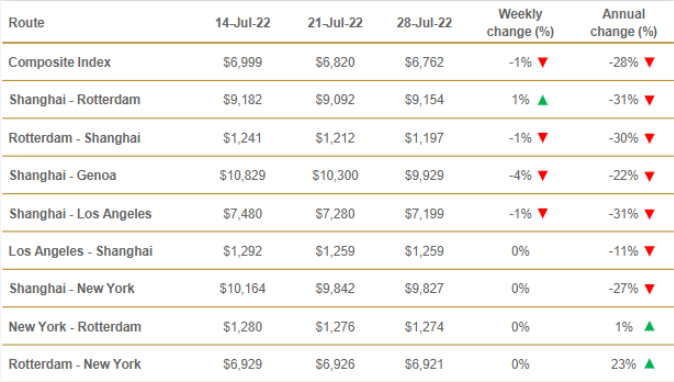

The latest Drury WCI composite index stood at $6,762 per 40-foot container, 35% below its peak of $10,377 reached in September 2021, but still 89% above its 5-year average of $3,574

Although the overall decline of the rise narrowed, the price of Los Angeles-Shanghai, Shanghai-New York, Rotterdam-New York and New York-Rotterdam is hovering around the previous week's level, but the Shanghai-Genoa route is still down as much as 4% in a week;

Mr. Drury expects the index to continue falling in the coming weeks.

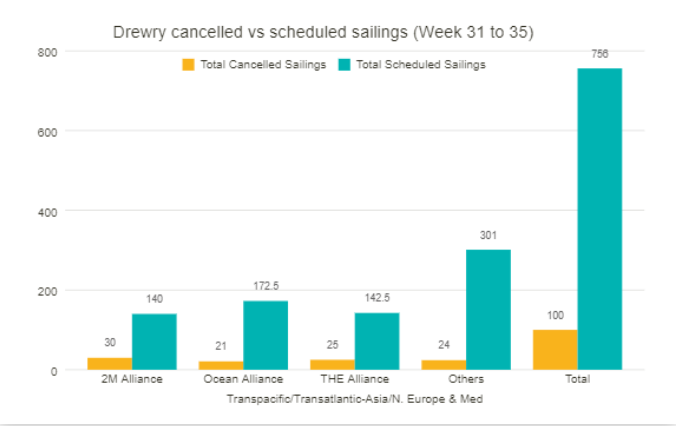

According to Drury's latest data, 100 cancellations have been announced between weeks 31 and 35 out of 756 scheduled sailings on major routes such as the Trans-Pacific, Trans-Atlantic and Asia-Nordic and Mediterranean routes, a cancellation rate of up to 13%

Of the canceled flights, 68 percent will be on east-bound trans-Pacific routes, mostly to the West Coast of the United States.

In terms of the suspension arrangements for the next five weeks (31-35 weeks), the three alliances have cancelled 76 routes in total, among which:

The 2M alliance announced 30 cancellations

THE League announced 25 cancellations

The OA league announced 21 cancellations

Post time: Aug-02-2022