Is there a bottom to the global shipping market?

For now, there is no bottom line, at least until the Lunar New Year shipments peak!

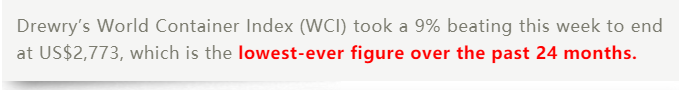

According to the latest edition of Drury's global Shipping market report, the World Container Shipping Rate Index (WCI), after falling for 36 weeks in a row, plunged another 9% last week, down 70% from the same period last year, and the index recorded the lowest level in the past two years.

Europe, South America began to accelerate a number of routes to cover the fall

According to our information: the latest data of Shanghai Shipping Exchange shows that the performance of China's export container transportation market is weak, the growth of transportation demand is weak, and the freight rate of ocean route market continues to decline, dragging down the composite index

The freight rate of the basic ports in Europe and South America increased gradually. On November 11th, the freight rate of the export from Shanghai to the basic ports in Europe was 1,478 USD /TEU, down 16.2%. The freight rate from Shanghai to South America was 2,944 USD /TEU, down 22.9%

According to the freight rate trend of the past month compiled by one Shipping line, the freight rate of many major shipping lines including Europe, America, South America and Australia and New Zealand is accelerating to cover the fall, which is too likely to catch the bottom!

By route, Asia to the U.S. / Spain fell another 2.9% this week to $1,632 per Feu, as did all other routes.

Freight rates in Europe and the United States may fall below pre-pandemic levels by the end of the year

According to our latest information, some experts predict that the spot freight rate of containers in Asia-Europe and trans-Pacific trade routes may fall below the pre-epidemic level before the end of this year.

And with operators' operating costs significantly higher than in 2019, this could force more routes back into the red in the first quarter of 2023.

According to Lars Jensen, CEO of Vespucci Maritime, a sharp drop in spot rates is "inevitable" due to extremely weak demand.

But he added that a recovery in freight rates could be supported by a possible rebound in demand after they bottom out.

There has been a sharp increase in the number of closures across the Pacific

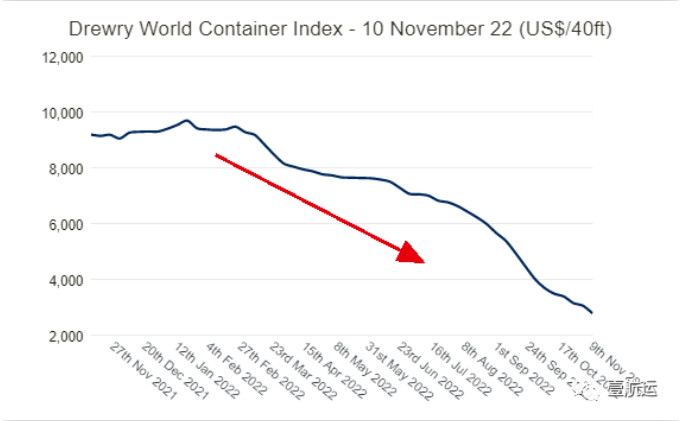

According to the latest data released by Drury, in the next 5 weeks (Week 46-50), 93 sailings out of 731 scheduled sailings on major routes such as Trans-Pacific, Trans-Atlantic, Asia-Nordic and Asia-Mediterranean have been announced, a cancellation rate of 13%

During this period, 59% of the blank voyages will be on trans-Pacific eastbound routes, 26% on Asia-Nordic and Mediterranean routes and 15% on trans-Atlantic westbound routes; Among them:

THE Alliance had the most cancellations, announcing 41

The 2M alliance announced 16 cancellations

The OA Alliance announced 15 cancellations

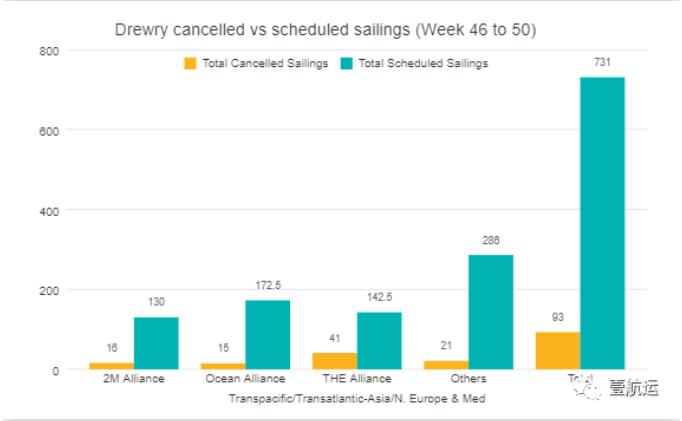

Meanwhile, according to the Sea-Intelligence report, there was a sharp increase in the number of blank flights on trans-Pacific routes during the 42-52 week period, but not as much air traffic on Asia-Europe routes.

There were 34 new blank sailings between the west coast of Asia and North America, and 16 new blank sailings between the east coast of Asia and North America. For the Spanish-American route, the line announced an additional 7-11 flights in all but five weeks of the analysis period.

Alab Murphy, chief executive officer of Sea-Intelligence, commented: "This reflects the hesitancy of shipping companies in how to handle the potential traffic ahead of Chinese New Year. "Shipping companies seem to be taking a more wait-and-see approach as to whether there will be a seasonal surge in demand."

There was no similar trend on the Asia-Europe route, which saw an increase of only six empty flights, while the Asia-Mediterranean route saw an increase of four empty flights.

Post time: Nov-18-2022