Everyone is hoping that the National Day holiday will help save the weak freight market, but everyone's good hopes may be in vain!

According to our latest news: after the National Day, Europe, North America, the Middle East and South America and other major routes freight rates are still depressed!

Information from the market front shows that the sea freight of the route between America and the West, known as the pioneer of freight reduction, quickly fell below the important threshold of $1,800 /40HQ within three days after the festival. Among them, the 40-foot NOR container (" Non Operating Reefer ": Cold dry containers) fell to an eye-watering $1,100.

All major shipping lines freight down

It is reported that the latest data of Shanghai Shipping Exchange shows that on September 30, the freight rates (sea freight and surcharge) of Shanghai port exports to the basic port markets of the west and East of the United States were 2399 US dollars /FEU and 6159 US dollars /FEU, down 10.6% and 5.8% respectively compared with the previous period

North American Routes:

The rate to the West was $2,399 per FEU, down 10.6% from the previous period

The U.S. East freight rate was $6,159 per FEU, down 5.8% from the previous period

European Routes:

The European basic port rate was $2,950 /TEU, down 6.7% from the previous period

Mediterranean-line rates were $2,999 per TEU, down 7.7% from the previous period

Persian Gulf: $912 /TEU, down 7.7% from the previous period

Australia-new Zealand: Rates were $1,850 /TEU, down 5.4% from the previous period

South American routes: $5025 /TEU, down 8.3% from the previous period

Separately, the World Container Freight Index (WCI) fell another 8% last week and is down 64% from a year earlier, according to the latest Drury data (October 6)

It is reported that the current decline in freight rates will be the first to challenge the break-even point. The head of a large freight forwarder pointed out that the break-even point of the big shipping companies in the case of port cancellation is 1,500 dollars.

For the large forwarding company, shipping company general manager and executive said, really have the beauty of the west route of shipping companies per trunk of cost between $1300 to $1500, is mainly depends on the size of the vessel capacity, is there any installation desulfurizer, besides plug plug port, whether oil prices on the high side, not along the route choice ports of call, cost control efficiency, etc are all influencing factors.

Will a permanent withdrawal of capacity stop freight rates from falling?

The National Day holiday did little to ease the slide in freight and charter rates, with the SCFI and CCFI indices "set to resume last week's decline" this week, according to Linerlytica.

An analyst at Linerlytica said: "Shipping lines are still reluctant to cut capacity and the easing of port congestion has offset much of the initial capacity cuts. Global port congestion fell to 10.5% from a peak of 15% in March."

HJ Tan, analyst at Linerlytica, said: "So far, the suspension of port hopping has been completely ineffective in stopping the decline in freight rates. What is needed now is a permanent removal of capacity from routes."

He said Linerlytica calculates that so far planned cuts on the West Coast account for less than 7 per cent of total trade capacity, while cuts on East Coast routes account for less than 2 per cent because the services being withdrawn "are already operating below full capacity anyway and some of that capacity will be brought back into the market. To fill the gap in service on remaining routes."

Mr Tan added: "Smaller vessel companies will retain trans-Pacific routes until October, including CU Lines, Transfar, BAL and Sea-Lead. At the same time, Wanhai will deploy its 13,200 TEU fleet on the US West Coast route by the end of October, effectively offsetting the impact of the withdrawal of two unconventional trans-Pacific routes."

"Unlike the situation in 2016 or 2020, when charter rates were low and order pressure was minimal, the opportunity cost of removing capacity today is too high."

Indeed, Linerlytica said the rapidly deteriorating supply-demand outlook had not deterred carriers from pushing ahead with capacity expansion plans, with both Maersk and MSC confirming more orders for new ships last week, "pushing container ship orders to an all-time high of 7.44 million TEUs."

Shipping companies continue to stop port hopping

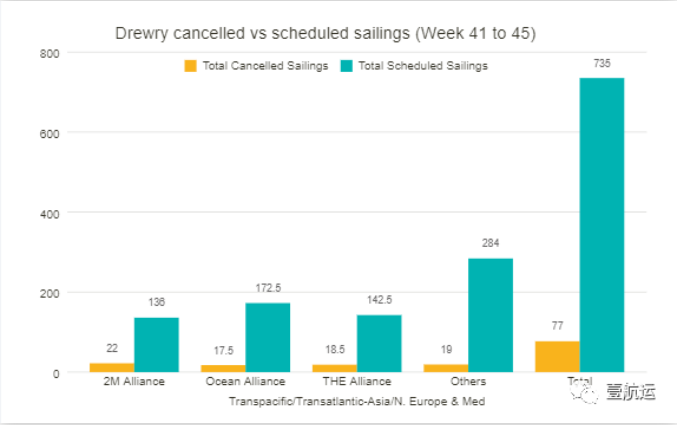

According to our information: For the next five weeks (weeks 41-45), 77 cancellations have been announced between weeks 41 (October 10-16) and 45 (November 7-13), out of a total of 735 scheduled voyages on major routes such as trans-Pacific, Trans-Atlantic, Asian-Nordic and Asian-Mediterranean routes. The cancellation rate is 10 percent

According to Drury, 60 per cent of air traffic during this period will take place on east-bound trans-Pacific trade routes, 25 per cent on Asia-Nordic and Mediterranean routes and 15 per cent on westbound trans-Atlantic routes.

In the following five weeks, the world's three major shipping alliances cancelled 58 sailings, accounting for 75% of the total number of sailings. Among them:

The 2M alliance canceled the most flights, announcing 22 cancellations

THE League announced 18.5 cancellations

OA league cancels 17.5 times

Mr Drury said: The transport industry is now transitioning from a period of insufficient capacity to a period of falling demand, which means capacity management has to be a top priority for rates to be supported.

Fears of a global recession, the risk of war and political instability have all led to a drop in consumer spending, along with manufacturing demand and trade volumes. As we enter a period of persistently weak demand, spot freight rates have been falling, and the world's major ocean carriers have been forced to take aggressive steps to manage capacity by cancelling more voyages and, in some cases, even terminating circle lines, particularly in trans-Pacific trade.

From an operational point of view, shippers and BCOs still face disruptions and delays, especially in transatlantic trade, where spot prices are high due to bottlenecks on both sides of the Atlantic and the characteristics of this relatively small trade, where a relatively small number of carriers control most of the market.

Post time: Oct-13-2022